Advanced Reconciliation Capabilities

for High Transaction Businesses

Continuous, real-time, multi-way cash reconciliation

Full Matching

One-to-one, one-to-many, many-to-one, and many-to-many transaction matching for high-volume, complex workflows

Full Stack

Match everything across your infrastructure as it happens, including pay-ins & payouts, AP & AR, and more

Every Transaction

Instantly match settled payments to corresponding invoices, including partial payments, refunds, chargebacks, failures, & multi-invoice payments

AI-Powered

Realize improved match rates with Ledge AI that learns and adapts as you scale

Ledge Product Tour

Tour Ledge now

Built for modern finance teams

CFOs & VPs

Reduce risk, improve cash flow, and increase confidence

Controllers

Own the close process with fewer surprises

AR & Billing leads

Accelerate cash, keep aging clean, and stop chasing manual matches

Accounting team

Close faster and focus on insights, not just manual cleanup

Operations

Provide answers & close tickets fast

We're on a mission to automate and simplify finance operations for teams working at scale.

New York

325 Hudson St, 4th Floor, New York,

United States 10013

Tel Aviv

Leonardo da Vinci St 14 Alef,

Floor 3

Tel Aviv, Israel

6473118

Got a question about reconciliation?

Account reconciliation software like Ledge automates high-volume transaction matching, even across many different sources and for complex one-to-one, one-to-many, many-to-one, and many-to-many transaction scenarios. Ledge uses AI and machine learning models to automatically match settled payments to the corresponding invoice, including partial payments, refunds, chargebacks, payment failures, and payments that cover multiple invoices.

No. Unlike legacy finance solutions that require extensive R&D or IT resources to set up, configure, and maintain on an ongoing basis, the Ledge platform is designed for quick integration, with zero need for IT or engineering resources, ensuring fast time to value and giving finance teams total independence. It's intuitive, flexible, and grows with you, handling increasing volumes and complexity without the need for additional headcount.

Ledge’s plug-and-play platform has pre-built integrations to 12,000+ institutions, banks, payment providers, ERPs, and databases. No coding, R&D, or IT resources are required—just click, connect, and let us do the rest.

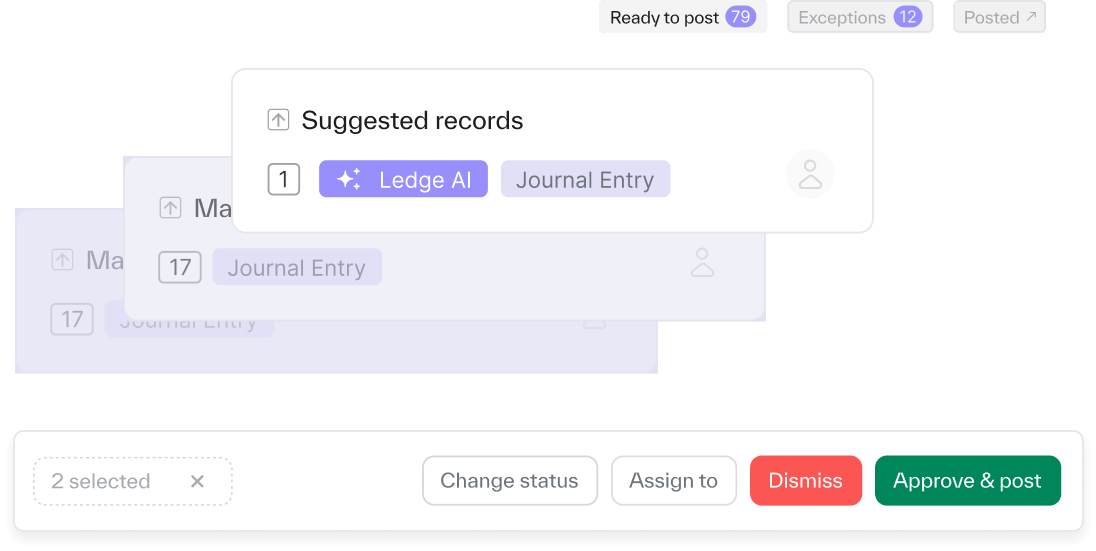

We keep your ERP your single source of truth by integrating directly with it and posting back to it with live data. Ledge supports the automatic preparation, creation, and posting of journal entries according to fully customizable predetermined rules and workflows. Not only does this greatly mitigate the risk of incorrectly recording a journal entry in your ERP, but it’s also a huge time saver. Set up whatever rules and approval flows work best for your team.

Ledge is a Software-as-a-Service (SaaS) solution that streamlines finance operations. We offer tiered pricing that’s tailored to align with your payment volumes and financial architecture. With no per-transaction fees, unlimited users, and white-glove onboarding, Ledge promises clear and simple pricing, and no surprises. Get a customized quote today.

Reconciling manually?

It’s time to automate it.

Payment reconciliation

Cash application

Journal entries

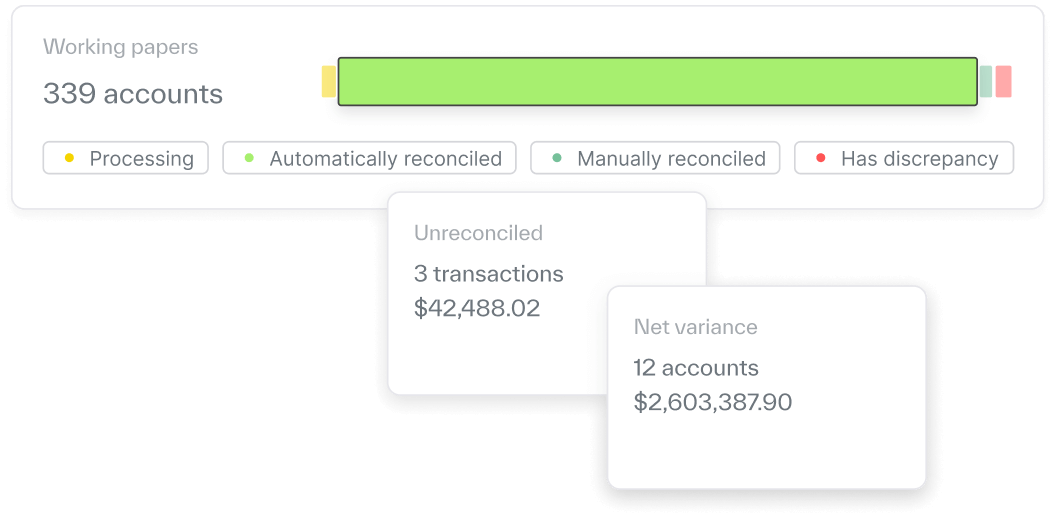

Account reconciliation

Intelligent cash application

AI agents match incoming payments to open invoices, even with missing, messy, or multi-source remittances.

For AR teams buried in PDFs, emails, and portal exports.

Learn moreMulti-system reconciliation

Continuously reconcile transactions across banks, payment processors, your ERP, and internal data warehouses, no V-LOOKUPs or batch delays.

For controllers managing high-volume, fragmented payment ecosystems.

Learn moreComplex journal entries

Automate intercompany, FX, fee, and accrual entries, with finance-owned logic and built-in approvals.

For teams doing all the JE prep in Excel because NetSuite doesn’t handle the complexity upstream.

Learn more

Account reconciliation

Reconcile accounts by matching transactions across systems - bank, ERP, PSP, internal or other - by entity, GL account, and currency. Automatically.

For controllers managing multi-account or multi-entity close processes with manual Excel dependency.

Learn more